Numero Vat Mexico

Solicita Amlo Al Papa Francisco Prestar A Mexico Tres Codices Y Mapas De Tenochtitlan El Heraldo De San Luis Potosi

Http Piketty Pse Ens Fr Files Sandoval15 Pdf

3 Simple Ways To Find A Company S Vat Number Wikihow

Tax Ids

Que Es Vat Number Importar De China Youtube

Zendesk Talk And Zendesk Text Number Regulatory Requirements Zendesk Help

IVA Impuesto al Valor Agregado Manuel preguntado mayo 21, 14;.

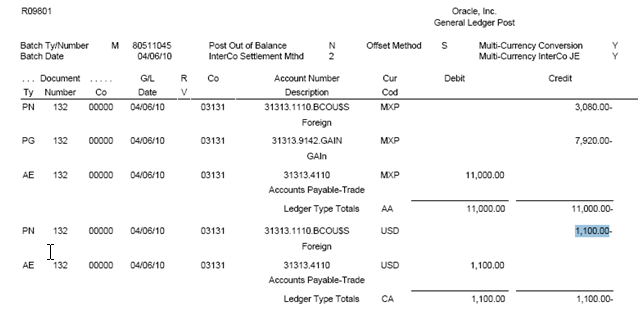

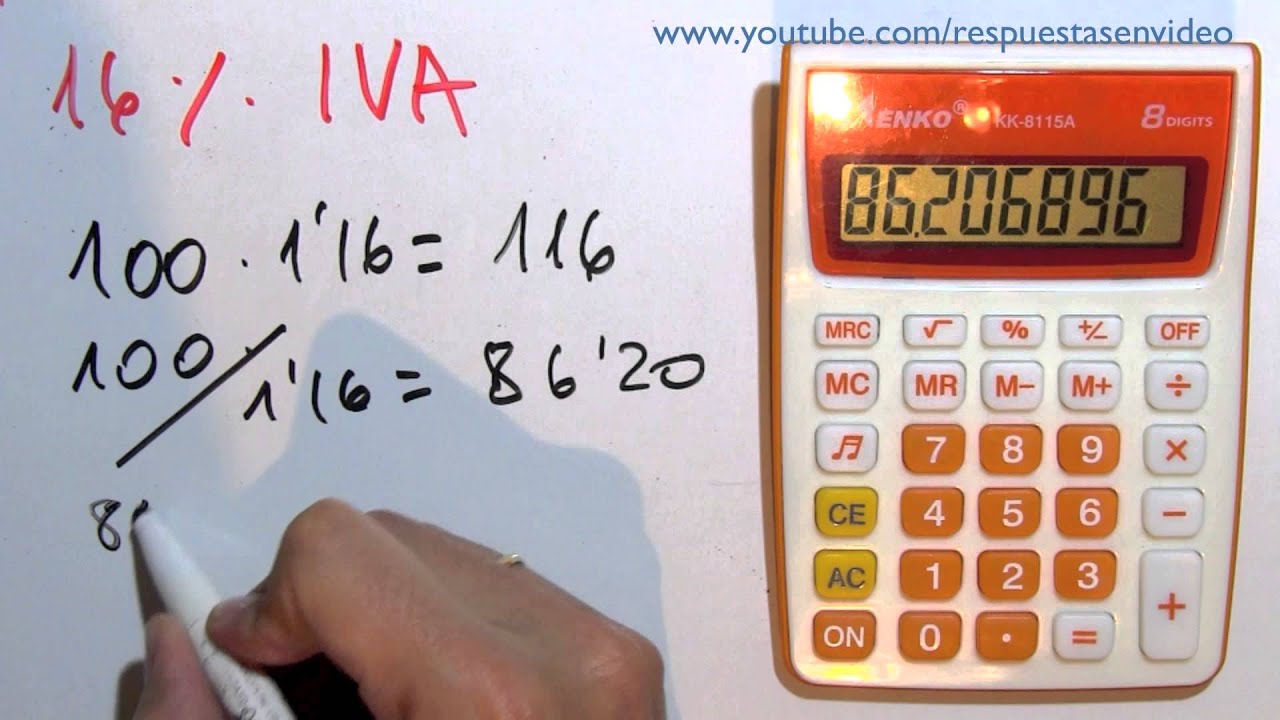

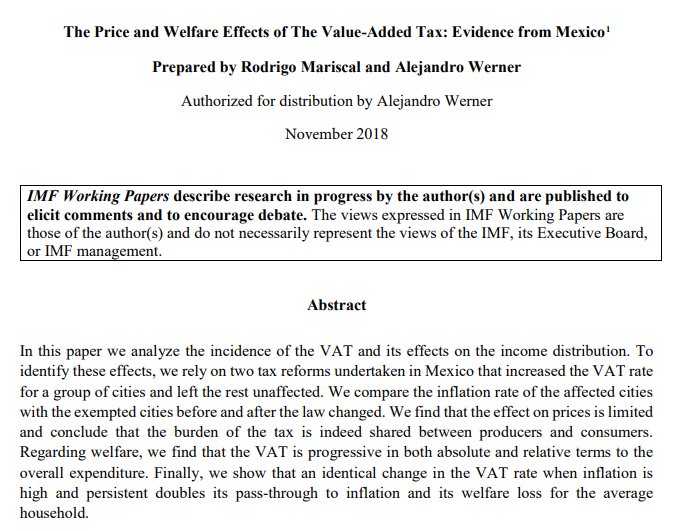

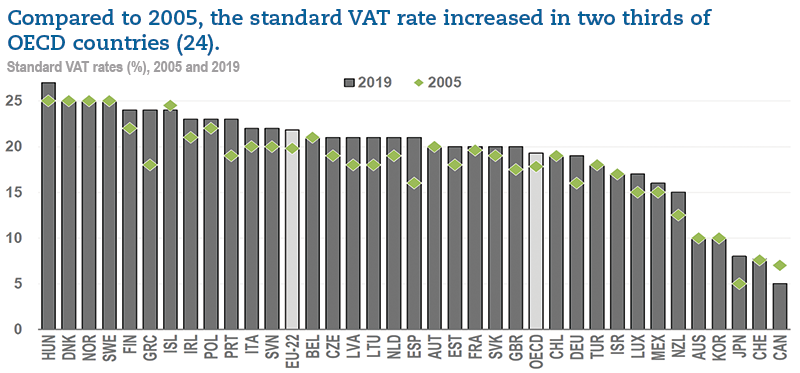

Numero vat mexico. Zoom is registered for VAT in Mexico through a specialized registration that was introduced from 1 June by the Mexican tax authorities This registration requires companies that are not resident in Mexico to register for VAT and collect VAT on supplies of digital services to all customers in Mexico. VAT in Mexico is governed by the ValueAdded Tax Act (Ley del Impuesto al Valor Agregado) It is the country’s main indirect tax and is applied at a standard rate of 16%, however there is a 0% rate for exports and the supply of local goods and services As with any other indirect tax, VAT is not paid directly, but is transferred or charged to a third party until it reaches the final consumer. ¿Es obligatorio, o puedo pedir que me.

Report property information to the Mexico tax authorities every month;. VAT, or Value Added Tax, is a system of indirect taxation In this quick VAT tutorial, I will walk you through the concept an. If you don't have or need a value added tax (VAT) registration number, you should leave the VAT registration section blank and proceed to the next step in the process (although you'll still need to confirm whether you're purchasing Facebook ads for business purposes and provide your business address).

Número VAT España La solicitud del VAT es sencilla, otra cosa son las comprobaciones que realice la Administración correspondiente para concederlo El primer paso es tener un NIF adjudicado y solicitar el alta en el ROI Ambas solicitudes se hacen con el Modelo 036 “Censo de empresarios y profesionales”, indicándolo en las casillas. Understanding VAT VAT is, in essence, a countrylevel sales tax that applies to most goods and services The tax can be applied at the standard rate, which, to use the European Union as an. What do you mean by "numbers"?.

Mexico – VAT obligation for noneresident companies providing electronic services September 9, 19 September 9, 19 Michaela Merz 1 Comment Amendment to the current VAT Law and the federal fiscal code was submitted to the Chamber of Deputies on 5 of September The aim is to amend the VAT Law in order to tax services provided through. La Comisión Europea emplea las dos expresiones VAT number y VAT identification number, en español, número de IVA y número de identificación de IVA Sin embargo, la Agencia Tributaria se refiere a él como el número de identificación fiscal (NIF) a efectos del IVA intracomunitario y opta por utilizar las siglas compuestas (NIFIVA) En las transacciones económicas entre empresas o. Edited at 0719 Collapse.

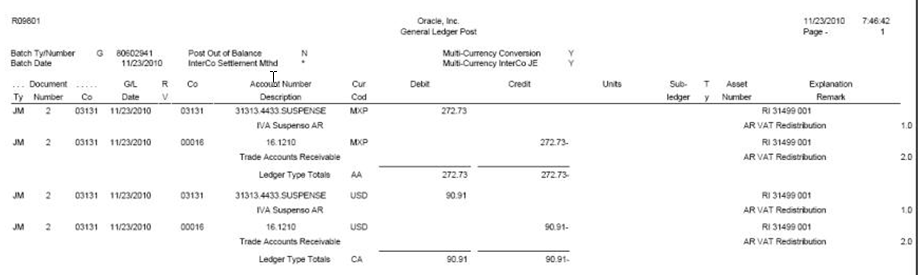

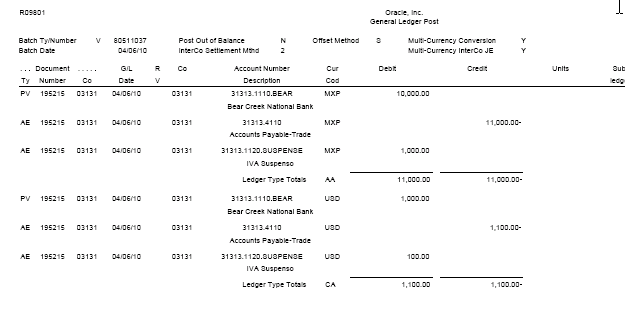

A value added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value added tax purposes In the EU, a VAT identification number can be verified online at the EU's official VIES website It confirms that the number is currently allocated and can provide the name or other identifying. Muy a menudo, el número de IVA será el único número de identificación fiscal en el país correspondiente Sin embargo, a veces, las autoridades fiscales pueden emitir dos números un número de impuesto local para las transacciones locales y comunicaciones con las autoridades fiscales;. This chapter provides overviews of how VAT (valueadded taxes) processing affects the general ledger and the setup for processing VAT on payments and receipts;.

VAT stands for value added tax A VAT number is a governmentissued identification code used to calculate and track charges and taxes across borders It is also used by companies to calculate the price that gets added to goods and services based on the demand or need for that good or service in a given country. Mexico – VAT obligation for noneresident companies providing electronic services September 9, 19 September 9, 19 Michaela Merz 1 Comment Amendment to the current VAT Law and the federal fiscal code was submitted to the Chamber of Deputies on 5 of September The aim is to amend the VAT Law in order to tax services provided through. Do European companies need US companies' tax numbers?.

And discusses how to Set processing options for POs Redistribute AP VAT Mexico (R76M1630) Set processing options for POs Redistribute AR VAT Mexico (R76M1010). Dipping Vat Campground is located adjacent to the west side of Snow Lake Snow Lake is approximately 52 miles southeast of Reserve, New Mexico The campground offers a variety of activities to the visitor, including fishing, overnight camping, and hiking Dipping Vat Campground has a potable water system including a well with a pump. How does VAT work?.

VAT number (numero de IVA) Hola Tengo una tienda de ropa y quiero comprar un stock de ropa en Inglaterra, pero el proveedor me solicita el VAT number (numero de IVA) ¿Dónde puedo conseguirlo?. Mexico federal law requires us to Display your federal taxpayer registration (RFC) number on invoices;. A European company VAT registration number is like a social security number but for businessesIn Europe, companies have different formats depending on which country.

The Sales Tax Rate in Mexico stands at 16 percent Sales Tax Rate in Mexico averaged 1573 percent from 06 until , reaching an all time high of 16 percent in 10 and a record low of 15 percent in 07 This page provides Mexico Sales Tax Rate actual values, historical data, forecast, chart, statistics, economic calendar and news. En este video explico qué es el número VAT que exigen en la mayoría de las páginas chinas Les dejo mi página en facebook, allí estaré subiendo más informaci. Are you asking for tax returns (the total number in taxes paid/accrued/remitted.

What is a BSB code?. The VAT is a sales tax that applies to the purchase of most goods and services, and must be collected and submitted by the merchant to the Mexico governmental revenue department Mexico has one of the lowest VAT tax rates in the world , charging a maximum VAT rate of 16%Countries with similar VAT rates include United Kingdom with a VAT of 18%. Mexico VAT and digital services, foreign residents Rules have been issued concerning how to address the value added tax (VAT) with regard to customer refunds, discounts, and cancelations of services provided by digital platforms of foreign residents not having a permanent establishment in Mexico Share.

La Comisión Europea emplea las dos expresiones VAT number y VAT identification number, en español, número de IVA y número de identificación de IVA Sin embargo, la Agencia Tributaria se refiere a él como el número de identificación fiscal (NIF) a efectos del IVA intracomunitario y opta por utilizar las siglas compuestas (NIFIVA) En las transacciones económicas entre empresas o. Last edited mayo 21, 14;. Quién necesita un número EORI Si tu empresa debe figurar como exportador o importador en un despacho aduanero de un envío a través de un puerto o aeropuerto español necesitarás un número EORI, de lo contrario el envío no se podrá despachar en las aduanas.

Mexico Parts production for CFM engines Located in Querétaro, 2 kilometers northwest of Mexico City, Safran Aircraft Engines Mexico is located in the aerospace park near the city's international airport Covering 12,000 square meters, the plant is specialized in parts production and module assembly, mostly for the CFM56 and LEAP powering Boeing jetliners, as well as the. VAT stands for value added tax A VAT number is a governmentissued identification code used to calculate and track charges and taxes across borders It is also used by companies to calculate the price that gets added to goods and services based on the demand or need for that good or service in a given country. The VAT number is based on the Swiss BID number and bears the added tag "MwST" (the German abbreviation for VAT) The BID number is the Business Identification Number For example CHE MWST You can search the BID Register using both the name of the business and the BID Number.

The VAT is a sales tax that applies to the purchase of most goods and services, and must be collected and submitted by the merchant to the Mexico governmental revenue department Mexico has one of the lowest VAT tax rates in the world , charging a maximum VAT rate of 16%Countries with similar VAT rates include United Kingdom with a VAT of 18%. Understanding VAT VAT is, in essence, a countrylevel sales tax that applies to most goods and services The tax can be applied at the standard rate, which, to use the European Union as an. VATSearch has more than 600 clients including By using VATSearcheu you agree that this website stores cookies on your local computer in order to enhance functionality such as remembering your input for further queries Read More Hide Contact Imprint GTC About VATSearcheu Language.

Dipping Vat Campground is located adjacent to the west side of Snow Lake Snow Lake is approximately 52 miles southeast of Reserve, New Mexico The campground offers a variety of activities to the visitor, including fishing, overnight camping, and hiking Dipping Vat Campground has a potable water system including a well with a pump. VAT number (numero de IVA) Hola Tengo una tienda de ropa y quiero comprar un stock de ropa en Inglaterra, pero el proveedor me solicita el VAT number (numero de IVA) ¿Dónde puedo conseguirlo?. 1 Mexico – Information on Tax Identification Numbers Section I – TIN Description Under this item, jurisdictions should provide a narrative description of the criteria governing the issuance of the TIN (eg some jurisdictions may only issue TINs to individuals, or to individuals that.

About Value Added Tax (VAT) Some countries require their businesses to register for value added tax (VAT) and add a VAT registration number to their ad account A VAT registration number is a unique identifier for the collection and remittance of VAT to the appropriate tax authorities The specific registration thresholds and signup processes. Número VAT qué es y cómo se tramita Holded junio 25, junio 26, 18 En el presente texto trataremos de explicar qué es el VAT y cómo puedes tramitarlo Pese a que este número se suele confundir con el NIF, aquí te explicaremos las diferencias claras que existen entre uno y otro. Likewise, a Mexican taxpayer is obliged to account for reverse charge VAT on the importation of intangible goods or services from a nonresident individual or entity (ie the nonresident is not required to register for VAT in Mexico in respect of the supply of services).

1 Mexico – Information on Tax Identification Numbers Section I – TIN Description Under this item, jurisdictions should provide a narrative description of the criteria governing the issuance of the TIN (eg some jurisdictions may only issue TINs to individuals, or to individuals that. Mexico has a national Valueadded tax (VAT) of 16% as of 21, administered by the Mexican Administration Tax Service (Servicio de Administración Tributaria, or SAT) Ministry Visit this page for an executive summary of Mexico's tax structure and rates, by SalesTaxHandbook. Value Added Tax (VAT) – IVA Value added tax (Impuesto al valor agregado) is paid at the time of purchase of a product or service It is paid by everyone and there is no distinction between residents and nonresidents There are four different rates of VAT.

¿Es obligatorio, o puedo pedir que me. Login For a better experience we recommend that you use the VATcom with Google Chrome, Mozilla Firefox and Microsoft Edge. Mexico introduced a Value Added Tax regime in 1980 Locally, it is known as Impuesto al valor agregado (IVA) It is administered by the Ministry of Public Finance and Credit.

Visit the Business Directory to find Englishspeaking accountants in Mexico City;. Collect and pay VAT to the Mexican government If applicable, withhold income tax Update your listing If needed, get your credentials on the Mexican tax website RFC. Mexico has free trade agreements with over 50 countries, including the European Union (EU), Japan, and many other countries around the world, placing more than 90% of trade under free trade agreements Mexico has been on a reform path for a number of years, privatising, deregulating, and cutting back the role of government.

Un número de identificación del contribuyente (TIN, por sus siglas en inglés) es un número de identificación utilizado por el Servicio de Impuestos Internos (IRS) en la administración de las leyes tributarias Lo emite la Administración del Seguro Social (SSA) o el IRS El número de Seguro Social (SSN) lo emite la SSA, mientras todos los otros TIN los emite el IRS. Value Added Tax (VAT Rates) per Country Including VAT (Value Added Tax) rates for Spain, France, Belgium, South Korea, Japan, Pakistan, Singapore and more. Si tienes un número de identificación fiscal para efectos del IVA (NIFIVA) registrado en la Comisión Europea, puedes asociarlo a tu cuenta de Airbnb Tanto los anfitriones que funcionan como empresa como los huéspedes que realizan sus pagos con un método facilitado por su empleador pueden seleccionar esta opción.

Como hemos adelantado, el VAT es un número de identificación que tiene el objetivo de que una empresa o trabajador autónomo pueda facturar a otras empresas de la Unión Europea Este número nace con la entrada en vigor del sistema único de pagos puesto en marcha en el continente, denominado SEPA. VAT registration number is also called a VAT numberVAT is the international designation for value added tax or sales taxDo you need to do a VAT number check?. Un número VAT permite a la Unión Europea mantener registros de las actividades empresariales de negocios que importan o exportan bienes en las áreas aplicables Esta información permite el cálculo del impuesto al valor agregado que una empresa debe pagar por llevar a cabo su negocio La cantidad precisa del impuesto varía por país.

An actual zerorated item is one that can have a valueadded tax charged to it at the final sale, but the end customer is charged a rate of 0% because of different regulations in various countries In the UK, for example, food products and children’s products come under this group Both VATexempt goods with the right to deduct and zerorated. Y un número de IVA extranjero o intracomunitario a. VATcom Login Username Password Login with office 365 Forgot Your Password?.

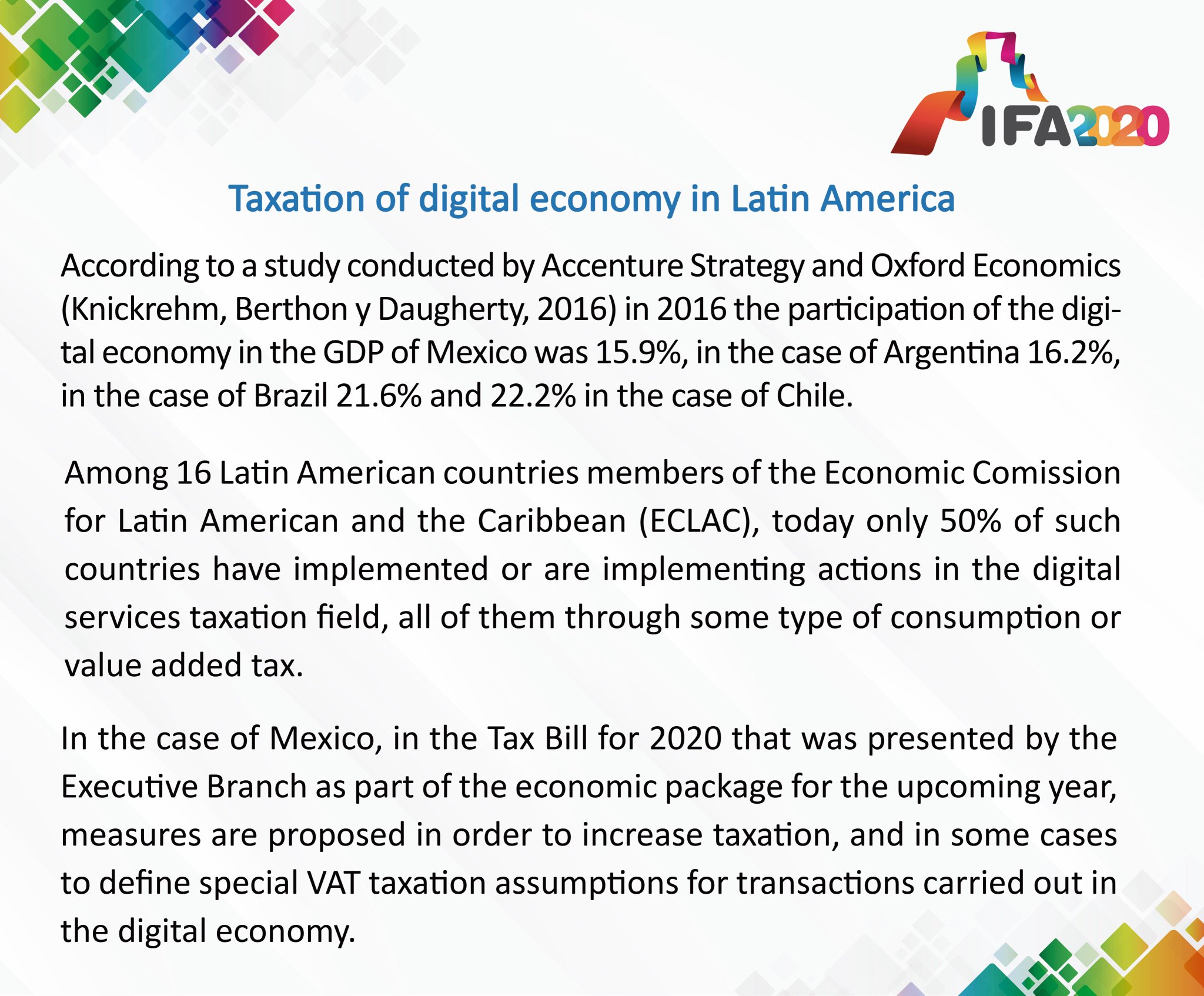

Mexico imposed a 16% VAT on digital services supplied by foreign businesses on June 1, As of January 8, 21, 70 nonresident digital businesses were registered with Mexico's tax authority, Servicio de Administración Tributaria (SAT) A key point about this law is that it simplifies existing rules in Mexico. About Value Added Tax (VAT) Some countries require their businesses to register for value added tax (VAT) and add a VAT registration number to their ad account A VAT registration number is a unique identifier for the collection and remittance of VAT to the appropriate tax authorities The specific registration thresholds and signup processes. Respuestas (4) Votos Actividad Fecha.

The Sales Tax Rate in Mexico stands at 16 percent Sales Tax Rate in Mexico averaged 1573 percent from 06 until , reaching an all time high of 16 percent in 10 and a record low of 15 percent in 07 This page provides Mexico Sales Tax Rate actual values, historical data, forecast, chart, statistics, economic calendar and news. Understanding VAT VAT is, in essence, a countrylevel sales tax that applies to most goods and services The tax can be applied at the standard rate, which, to use the European Union as an. Worldwide VAT, GST and Sales Tax Guide 19 May (pdf) Download 4 MB While greatly accelerating the pace of all their tax legislation, the world’s governments continue to rely heavily on indirect taxes as an invaluable source of revenue As a result, there is increased risk that taxpayers will be caught unprepared, making a current.

There's probably also a good reason for wanting to know the VAT number of translators In principle, the VAT number is the number under which a legal entity is registered at the local tax office If possible, simply state there is no such thing as a VAT number in the States Good luck!. Si lo necesitas, puedes descargar una copia de nuestro formulario W9 y usar nuestro número de identificación de contribuyente (TIN, Taxpayer Identification Number) de los EE UU El Id de IVA de Dropbox International Unlimited Company es IE J. Read this in German instead How do I check a European VAT number?.

El numero VAT es un número que obtienen las empresas inglesas para trabajar con su agencia tributaria en temas de IVA (VAT=IVA) En ciertos paises cada compañía tiene dos numeros, el de IVA o de VAT y el de identificación mercantil. VAT in Mexico is governed by the ValueAdded Tax Act (Ley del Impuesto al Valor Agregado) It is the country’s main indirect tax and is applied at a standard rate of 16%, however there is a 0% rate for exports and the supply of local goods and services As with any other indirect tax, VAT is not paid directly, but is transferred or charged to a third party until it reaches the final consumer. Mexico has a national Valueadded tax (VAT) of 16% as of 21, administered by the Mexican Administration Tax Service (Servicio de Administración Tributaria, or SAT) Ministry Visit this page for an executive summary of Mexico's tax structure and rates, by SalesTaxHandbook.

Disculpe quiero realizar una compra personal en linea de china pero el sitio me pide que les ponga mi número VAT el cual desconozco el término ¿Cuál es o tengo que realizar trámites?. Mexico Parts production for CFM engines Located in Querétaro, 2 kilometers northwest of Mexico City, Safran Aircraft Engines Mexico is located in the aerospace park near the city's international airport Covering 12,000 square meters, the plant is specialized in parts production and module assembly, mostly for the CFM56 and LEAP powering Boeing jetliners, as well as the. A valueadded tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid.

Value added tax (VAT) explained For any company doing business outside of the United States, three little letters — VAT — can make a big difference to your business VAT stands for value added tax It’s also known as goods and services tax (or GST) VAT is the equivalent of sales tax in the United States but with many major differences. Devoluciones de IVA a no establecidos (VAT Refund) IVA Telecomunicaciones, Radiodifusión, TV y Servicios electrónicos (OneStop Shop) Exenciones y devoluciones en el marco de relaciones diplomáticas, consulares, organismos internacionales y OTAN.

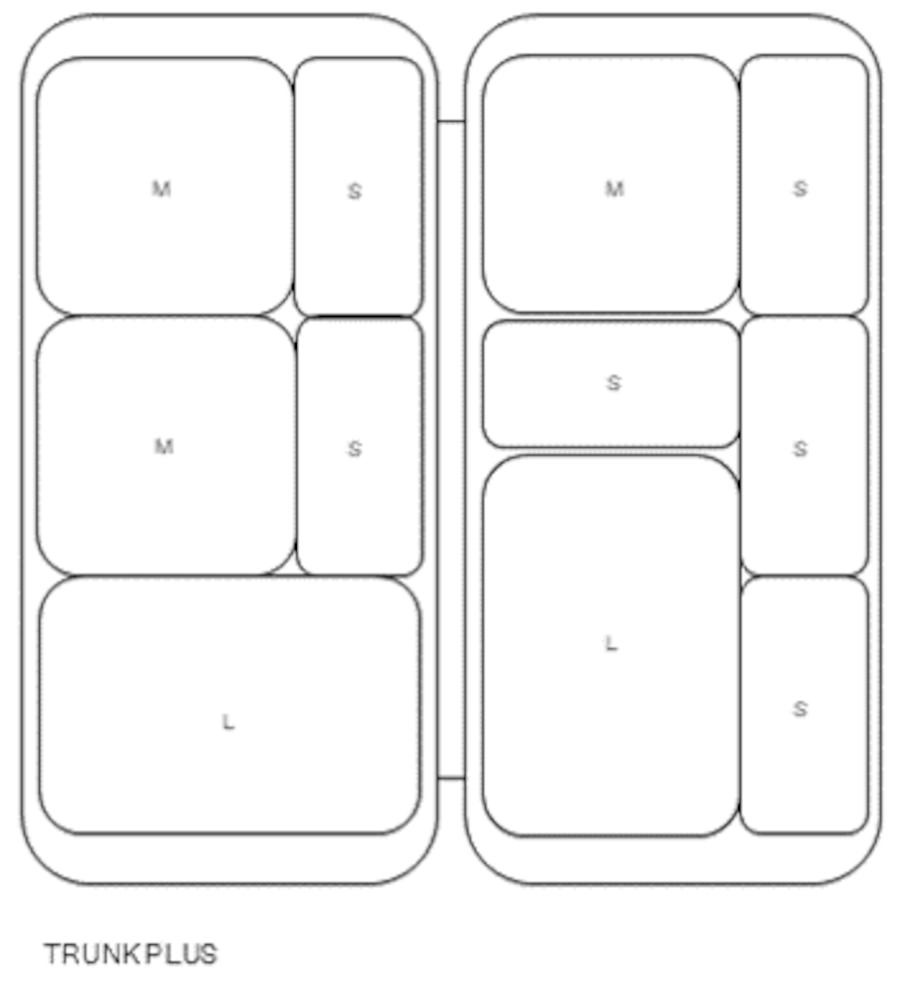

Faq Frequently Asked Questions Rimowa

2

3 Simple Ways To Find A Company S Vat Number Wikihow

Que Es El Vat Y Como Tramitarlo Circulantis

Proceso De Iva En Mexico

Guide To Exporting Equipment And Obtaining Your Iva

Noticias Al Dia Pide Mexico Al Vaticano El Prestamos De Codices Y Solicita Disculpas

The Mexican Value Added Tax Iva System A General Overview Part I Sovos

Simple And Transparent Vat Compliance Everywhere Vatglobal

Simple And Transparent Vat Compliance Everywhere Vatglobal

Mexico Vat Guide For Businesses

Http Piketty Pse Ens Fr Files Sandoval15 Pdf

Vat For Freelancers Basics You Need To Know Kontist

Obtaining An Rfc Or Vat Registration Number To Sell On Amazon Mexico Incorporating In Mexico

3 Simple Ways To Find A Company S Vat Number Wikihow

Vat Reporting Analysis Software Making Tax Digital Mtd Sovos

Vicente Fox Wikipedia

Competition Adesignaward Com Document Download Php Id 143

2

Munich Re Worldwide Munich Re

2

1

Frequently Asked Questions About Taxes Zoom Help Center

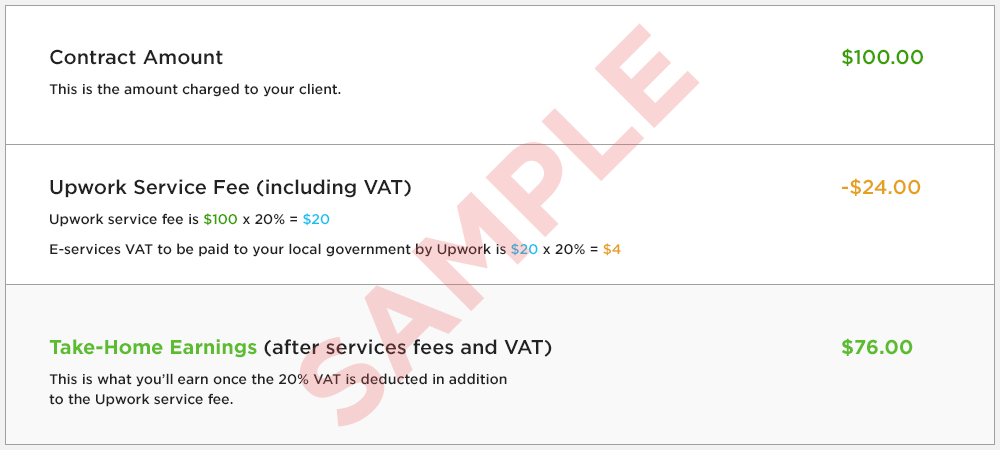

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Supplier Coty Com Sites Default Files Wella Company Reminder Mexico Newcoty Sve English Pdf

Tax Ids

Proceso De Iva En Mexico

Invoice Addresses Upm Com

Obtaining An Rfc Or Vat Registration Number To Sell On Amazon Mexico Incorporating In Mexico

Como Sacar El 16 Por Ciento De Iva De Una Cantidad Total Mexico Youtube

Hotel Nh Collection Mexico City Airport T2 Nh Hotels Com

Simple And Transparent Vat Compliance Everywhere Vatglobal

Vat For Freelancers Basics You Need To Know Kontist

Http Www Uccs America Org Archivos Impuestos en america 13 Taxes in mexico Pdf

Pleasuretravel

Rodrigo Mariscal Rodmariscal Twitter

How To Pay Taxes

Q Tbn And9gcqz5 C6nxebqr6eymlyvnmxrm71f7tcki2opst Ojywahwbmcbm Usqp Cau

European Vat Number

Cantina Wikipedia

Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Mexico Tin Pdf

Vat Reporting Analysis Software Making Tax Digital Mtd Sovos

Pdf Superior Parasites Of The Central American Tapir Tapirus Bairdii Perissodactyla Tapiridae In Chiapas Mexico Spanish 1library Co

Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Mexico Tin Pdf

3 Simple Ways To Find A Company S Vat Number Wikihow

Oecd Tax Database Oecd

Simple And Transparent Vat Compliance Everywhere Vatglobal

3 Simple Ways To Find A Company S Vat Number Wikihow

2

Segmented Ball Bars 3m 12m Trapet De

Preguntas Frecuentes Sobre La Retenci Oacute N Del Impuesto Sobre La Renta Isr En M Eacute Xico Seller Central De Amazon

Simple And Transparent Vat Compliance Everywhere Vatglobal

Que Es El Numero De Identificacion Fiscal Diccionario Financiero

Pdf The Prehospital Emergency Care System In Mexico City A System S Performance Evaluation

Que Es El Vat Number Para Que Sirve Como Solicitarlo

Steps To Create Your Account Freepik Support

Mexico Vat International

Impuesto Al Valor Agregado Wikipedia La Enciclopedia Libre

Proceso De Iva En Mexico

North America Country Vat Guide Avalara

Vat Reporting Analysis Software Making Tax Digital Mtd Sovos

2

What Is A Vat Number Eu Vat Number For Business

12 Galaz Yamazaki Ruiz Urquiza S C January 12 Tax Compliance Recent Publications Hector Silva Tax Partner Deloitte Wmta Breakfast Meeting Ppt Descargar

2

Mexico Latin Lawyer

Steps To Create Your Account Freepik Support

Http Piketty Pse Ens Fr Files Sandoval15 Pdf

Obtaining An Rfc Or Vat Registration Number To Sell On Amazon Mexico Incorporating In Mexico

Mexico Latin Lawyer

Segmented Ball Bars 3m 12m Trapet De

Www Te Gob Mx Repositorio 0f09 A 19 Viaticos e Pdf

Pdf El Establecimiento Del Iva En Mexico Un Problema Politico Economico 1968 1980

Www Consar Gob Mx Gobmx Recursos Solicicitud 17 M C3 93nica leticia mendoza archer Enero 17 Pdf

Vat For Freelancers Basics You Need To Know Kontist

Http Piketty Pse Ens Fr Files Sandoval15 Pdf

Ifa Cancun 22 Taxation Of Digital Economy In Latin America

Industry Reports Cannabis Markets Prohibition Partners

Proceso De Iva En Mexico

Colaboracion Uv Mx Abogado Asuntosjuridicos Documentos Transparencia Conveniosycontratos 17 Convenios 5mayo 2 12 mayo 17 universitat autonoma de barcelona 2c espa C3 91a Pdf

Vat For Freelancers Basics You Need To Know Kontist

2

2

Blutec Blog Textil News

Bank Transfer Faq Send Money To The United States Worldremit

Proceso De Iva En Mexico

Mexico Locations Baker Mckenzie

2

2

Required Documents Dhl Export Services Dhl Go Global

Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Mexico Tin Pdf

Hotel Nh Collection Mexico City Airport T2 Nh Hotels Com

Www Bi Team Wp Content Uploads 19 11 Guatemala 6 Tr Encourage Timely Declaration Of Tax 1 Pdf

Puedo Deducir Las Facturas De Facebook Ante El Sat O Hacienda Maulex Zazueta

Http Transparencia Cdmx Gob Mx Storage App Uploads Public 5aa 03c 7aa 5aa03c7aa Pdf