Put Y Call Option

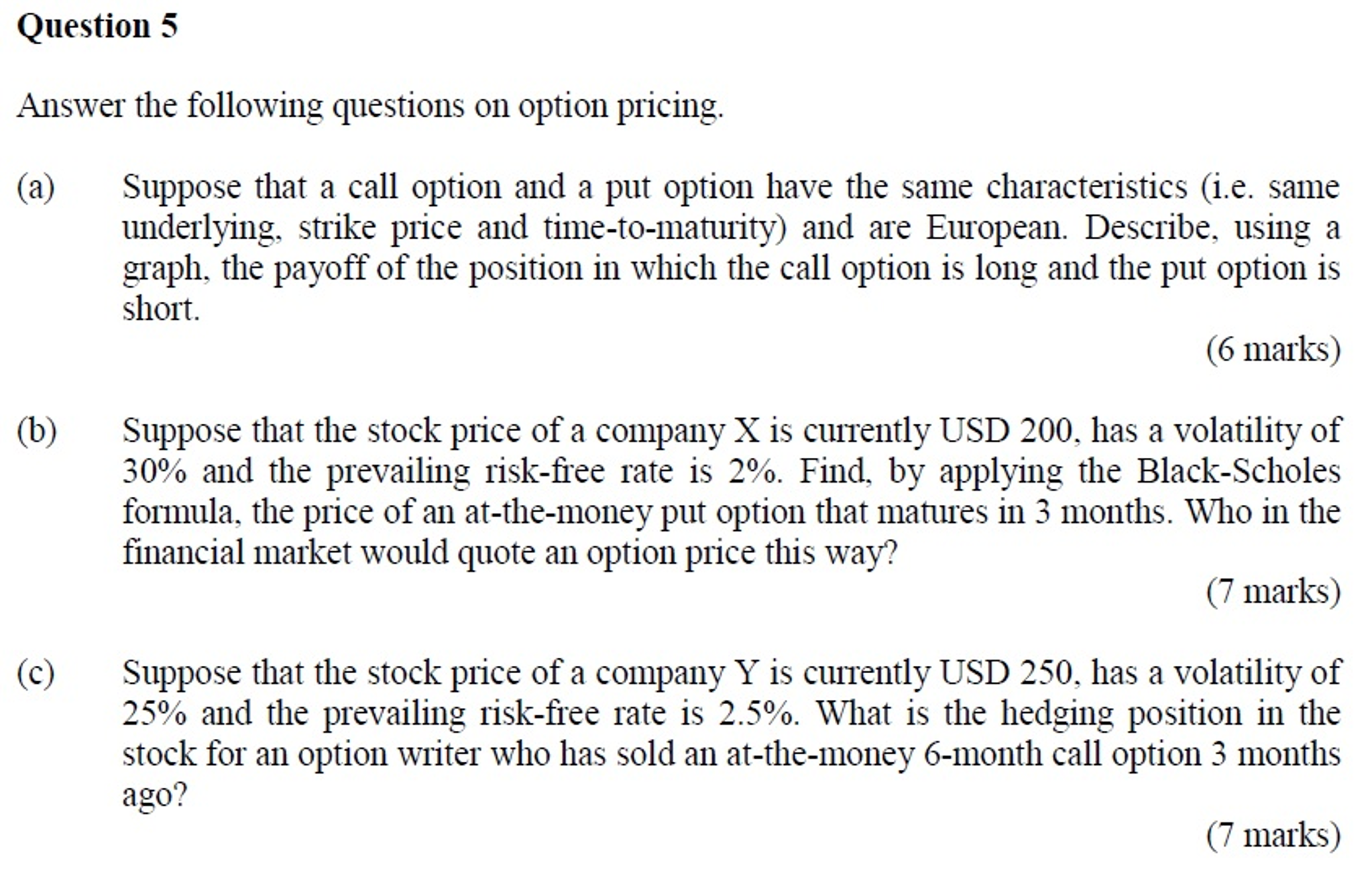

Doi Org 10 5901 Mjss 17 V8n1p46

What Are Options And What Is Options Trading Kotak Securities

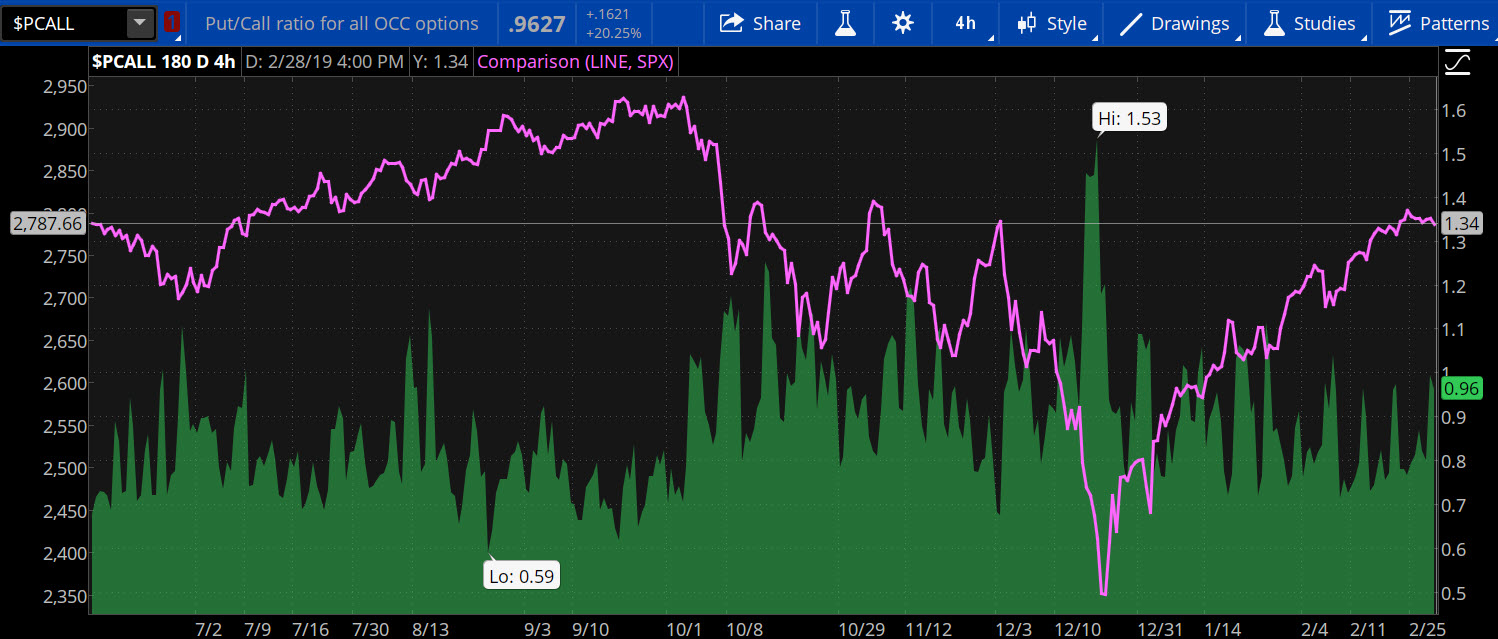

Using The Put Call Ratio To Gauge Stock Market Sentiment Ticker Tape

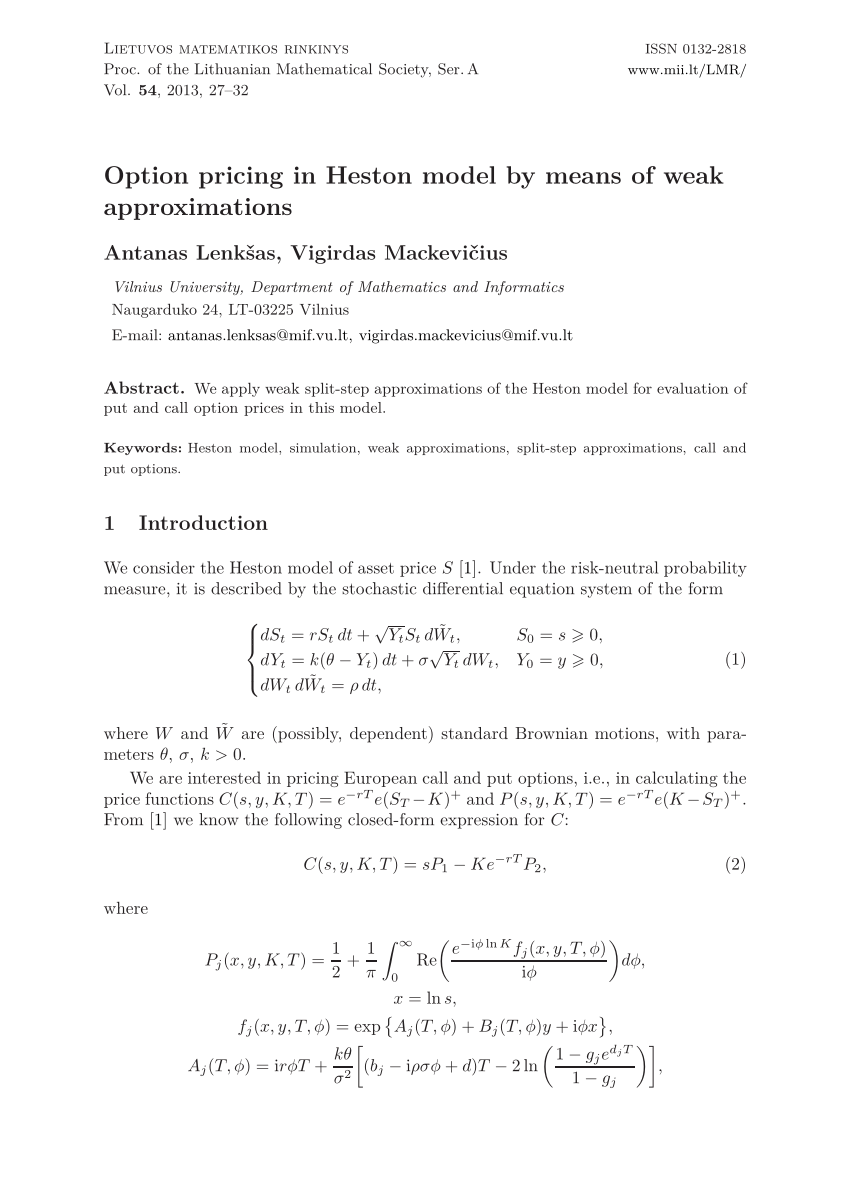

European Put And Call Option Prices P S Y K T And C S Y K T Download Scientific Diagram

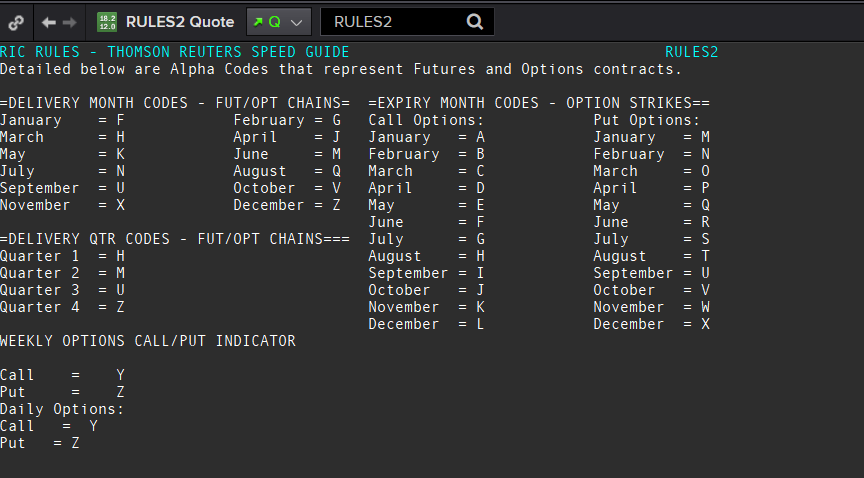

Delta Hedging Simplify Your Option Pricing Refinitiv Developers

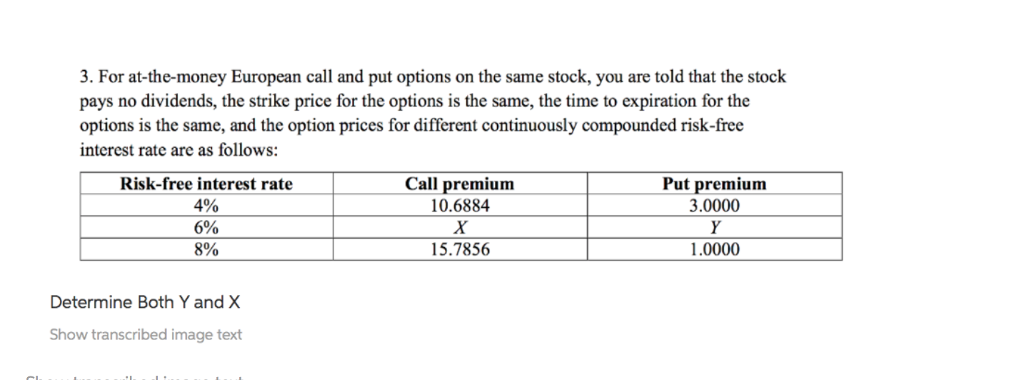

2

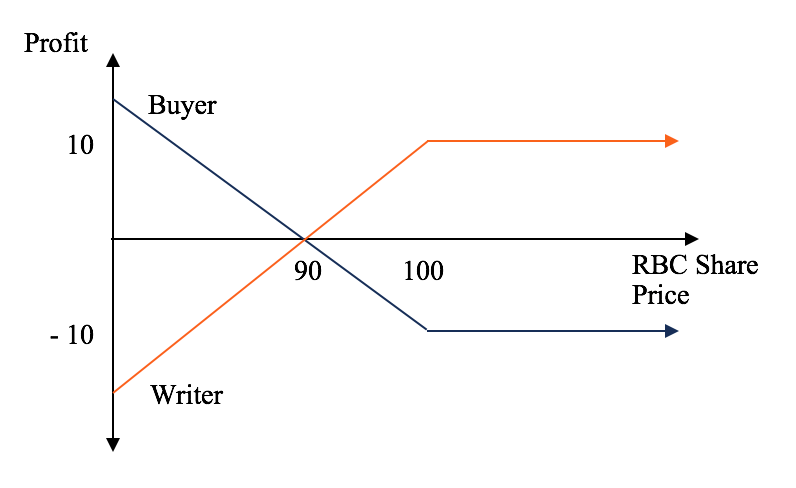

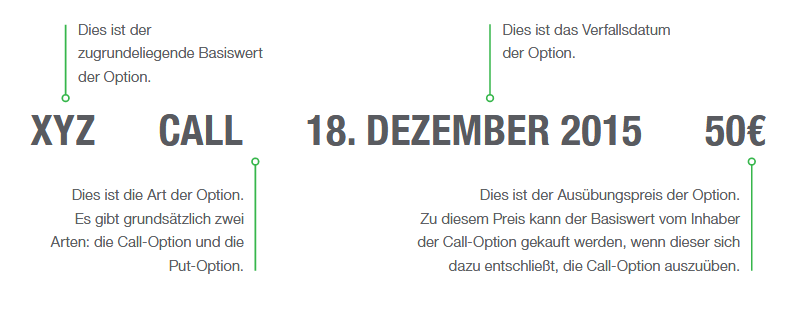

For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's strike price represents the amount of profit per share gained upon the exercise.

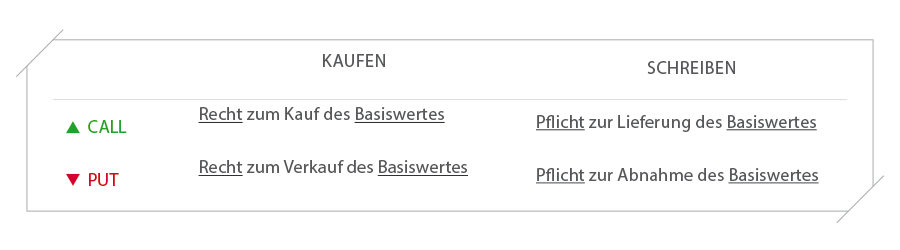

Put y call option. Puts and calls are short names for put options and call options When you own options, they give you the right to buy or sell an underlying instrument You buy the underlying at a certain price. Puts and calls are short names for put options and call options When you own options, they give you the right to buy or sell an underlying instrument You buy the underlying at a certain price. The call and put options are the building blocks for everything that we can do as a trader in the options market There are only two types of options contracts, namely the call vs put option Let’s dig deeper A call option is when you bet that a stock price will be above a certain price on a certain date.

PutCall Ratio The putcall ratio is an indicator ratio that provides information about the trading volume of put options to call options The putcall ratio has long been viewed as an indicator. Call vs Put Option As previously stated, the difference between a call option and a put option is simple An investor who buys a call seeks to make a profit when the price of a stock increases. View the basic GOOG option chain and compare options of Alphabet Inc on Yahoo Finance.

For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's strike price represents the amount of profit per share gained upon the exercise. The call option just like a put option can be sold anytime up until expiration for a profit or loss When selling a call option, the option trader has the obligation to sell the underlying to the buyer at the strike price up until expiration if he or she desires to do so (called exercising their right). Enter an expected future stock price, and the Option Finder will suggest the best call or put option that maximises your profit Try Option Finder or read more about it Updates Compare an options trade vs the underlying stock purchase using the 'stock comparison' line in the Line Chart.

Option Symbol/Option Type Column 1 usually identifies the option what type, the company, or the security Here, you see the option symbol for a call option of MMC with a strike price of $50 expiring March 18, 16 Here is a breakdown of the symbol MMC MMC Stock symbol 16 03 18 Expiration date (YearMonthDay) C Type of option (C = call. There are several components to the value of a call or put option trade An option's value is made up of its intrinsic value plus a time premium The current value of your option trade depends on. If the call option holder decides to exercise the right in the contract, the seller is obligated to sell the underlier at the strike price The opposite of a call option is the put options Put options give the options holder rights to sell an underlier at a strike price at a forward date Both call options and put options trade in the Indian.

View the basic SPY option chain and compare options of SPDR S&P 500 on Yahoo Finance. The putcall ratio for the security is 1,250 / 1,700 = How to Interpret the PutCall Ratio 1 Interpreting the Number A PCR below one (. The call option is clearly worthless You wouldn't exercise the call option if the stock is worth zero You would want to buy something for $50 that's worth 0 So from the stock's being worth zero, all the way up to the stock being worth $50, you would want to exercise the put option But the value of the put option is going to become lower and.

Turning to the calls side of the option chain, the call contract at the $ strike price has a current bid of $930 If an investor was to purchase shares of ARKG stock at the current price. Please support us athttps//wwwpatreoncom/garguniversity In finance, an option is a contract which gives the owner the right, but not the obligation, to b. There are only 2 types of options contracts Calls and Puts Everything in the options trading world revolves around the use of these 2 contract types In th.

View TSLA's options chain, put prices and call prices at MarketBeat S&P 500 3, DOW 31, QQQ Top 3 Materials Stocks to Buy for 21 3 Stocks to Watch This Earnings Season Here’s Where Xpeng (NASDAQ XPEV) Stock Looks Attractive. Cboe Volume & Put/Call Ratios Cboe Volume and Put/Call Ratio data is compiled for the convenience of site visitors and is furnished without responsibility for accuracy and is accepted by the site visitor on the condition that transmission or omissions shall not be made the basis for any claim, demand or cause for action. Put option (ie, an arrangement similar to but not exactly the same as a forward contract) Accounting for these types of arrangements can be difficult, due to the complexity and volume of authoritative guidance that needs to be considered The accounting often is affected by whether (1) the feature (eg, call option, put option, forward.

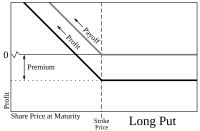

Turning to the calls side of the option chain, the call contract at the $5800 strike price has a current bid of $216 If an investor was to purchase shares of LVS stock at the current price. A call option provides you with profits similar to long stock, whereas a put option provides you with profits similar to short stock This makes sense given your rights as an option holder, which allow you to buy or sell stock at a set level There is one slight difference between stock rewards and option rewards Options require an initial. Unlike a call option, a put option is essentially a wager that the price of an underlying security (like a stock) will go down in a set amount of time, and so you are buying the option to sell.

On the CALLS side of the options chain, the YieldBoost formula looks for the highest premiums a call seller can receive (expressed in terms of the extra yield against the current share price — the boost — delivered by the option premium), with strikes that are outofthemoney with low odds of the stock being called away. Turning to the calls side of the option chain, the call contract at the $ strike price has a current bid of $930 If an investor was to purchase shares of ARKG stock at the current price. A call option, often simply labeled a "call", is a contract, between the buyer and the seller of the call option, to exchange a security at a set price The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at a certain time (the expiration date) for a.

As the call and put options share similar characteristics, this trade is less risky than an outright purchase, though it also offers less of a reward These strategies are useful to pursue if you believe that the underlying price would move in a particular direction, and want to reduce your initial outlay if the prediction is incorrect. View the basic QQQ option chain and compare options of Invesco QQQ Trust, Series 1 on Yahoo Finance. พร้อมสิ่งที่เทรดเดอร์ Options Trading มือใหม่ต้องรู้.

While opposite in their approach to taking advantage of market movements, a call option and a put option both offer the opportunity to diversify a portfolio and earn another stream of income News from the World's Most Trusted Financial Advisors. Presenting Option Analyzer app for smart option tradersCall option & Put option analysis can be done now with few clicks Greeks such as Delta, Gamma, Theta, Vega & value can be calculated using options calculator Option price movement & other option parameters can be tracked using the portfolio and watch feature Main features of the app 1. Call/Put options are the simplest ones and they are currently one of the best ways to begin your binary option trading career Call Option Let’s say that you’ve picked an asset that you want to trade and you’ve already read the data provided by the technical tools You’ve analyzed all the information and recent financial news and you.

A call option provides you with profits similar to long stock, whereas a put option provides you with profits similar to short stock This makes sense given your rights as an option holder, which allow you to buy or sell stock at a set level. Type of option means the classification of an option as either a ‘Put’ or a ‘Call’ What is exercise style?. However put options and call options are often combined in one transaction, called a “put and call” option to achieve much the same effect as a conventional contract This is because if the buyer doesn’t exercise its call option, the seller can compel the buyer to proceed under the put option.

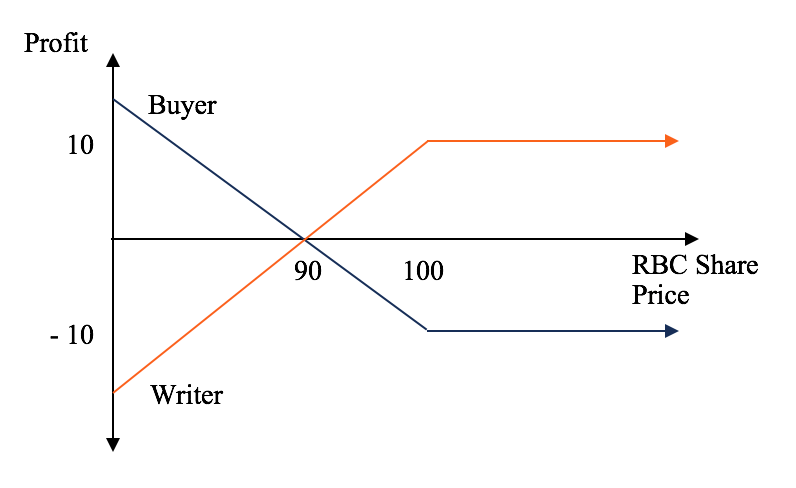

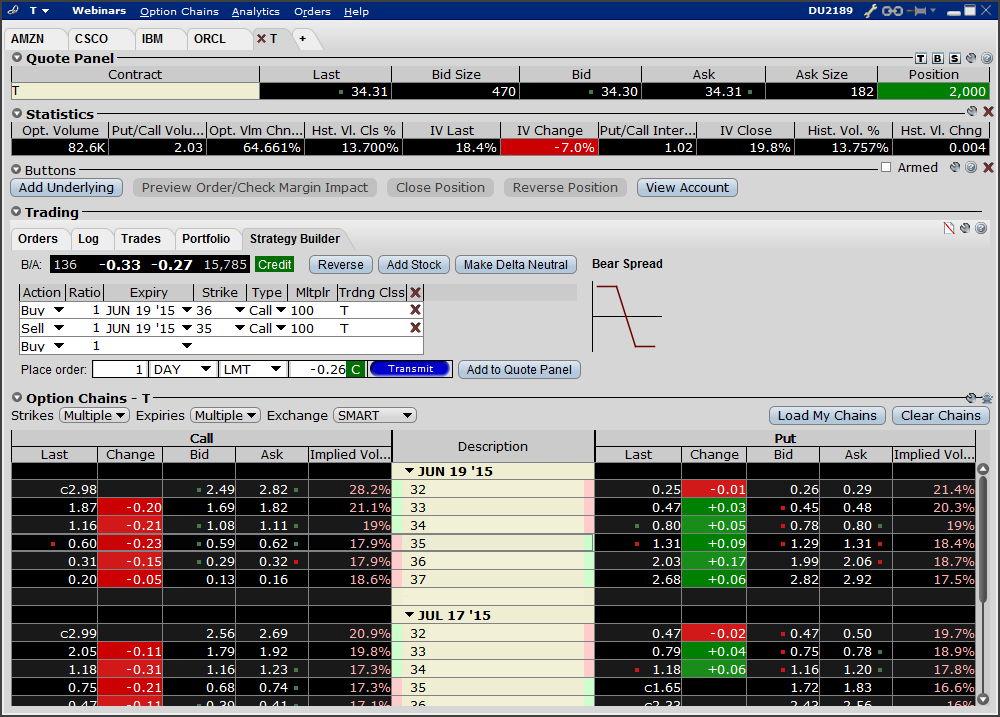

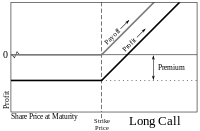

Long call position is created by buying a call option To initiate the trade, you must pay the option premium – in our example $0 Short put position is created by selling a put option For that you receive the option premium Long call has negative initial cash flow Short put has positive. A call spread is an option strategy in which a call option is bought, and another less expensive call option is sold A put spread is an option strategy in which a put option is bought, and another less expensive put option is sold As the call and put options share similar characteristics, this trade is less risky than an outright purchase, though it also offers less of a reward. Type of option means the classification of an option as either a ‘Put’ or a ‘Call’ What is exercise style?.

Cboe Volume & Put/Call Ratios Cboe Volume and Put/Call Ratio data is compiled for the convenience of site visitors and is furnished without responsibility for accuracy and is accepted by the site visitor on the condition that transmission or omissions shall not be made the basis for any claim, demand or cause for action. A call option provides the buyer of a call option with a hedge against rising prices Conversely, a put option provides the buyer of the put option with a hedge against declining prices As an example of how a fuel consumer (also referred to in the industry as an “enduser”) can utilize call options to hedge their exposure to fuel prices. Ya lei tu instructivo y me suscribi, ahora te envio esto para que me orientes un poco mas La idea es iniciar con las opciones, obviamente aprender a utilizar primero el call (alcista)(oblig a venderlo al precio que yo estimo en el plazo que yo estimo) y despues el put (bajista) (no me obliga a venderloal vencimiento) "esto es lo que yo entendi.

Call and Put Option Trading Tip When you buy a call option, you need to be able to calculate your breakeven point to see if you really want to make a trade If YHOO is at $27 a share and the October $30 call is at $025, then YHOO has to go to at least $3025 for you to breakeven. Differences Between Call and Put Options The terminologies of call and put are associated with the option contracts An option contract is a form of a contract or a provision which allows the option holder the right but not an obligation to execute a specific transaction with the counterparty (option issuer or option writer) as per the terms and conditions stated. Turning to the calls side of the option chain, the call contract at the $ strike price has a current bid of $930 If an investor was to purchase shares of ARKG stock at the current price.

The put/call parity concept was introduced by economist Hans R Stoll in his Dec 1969 paper "The Relationship Between Put and Call Option Prices," published in The Journal of Finance. The third definition, in particular, is oftentimes a useful indicator to help determine which calls to buy You can use the option’s delta to determine what percentage of price risk you want to take versus buying the stock outright If you buy a 70 delta call, you have 70% of the price risk versus owning the stock outright. ในบทความนี้ เราจะพาไปทำความรู้จัก Call Option และ Put Option กันว่าคืออะไร ?.

CBOE Equity Put/Call Ratio is at a current level of 037, N/A from the previous market day and down from 048 one year ago This is a change of N/A from the previous market day and 2292% from one year ago. The call option just like a put option can be sold anytime up until expiration for a profit or loss When selling a call option, the option trader has the obligation to sell the underlying to the buyer at the strike price up until expiration if he or she desires to do so (called exercising their right). The SPX Put/Call Ratio is an indicator that is used to gauge market sentiment This is calculated as the ratio between trading S&P 500 put options and S&P call options A high put/call ratio can indicate fear in the markets, while a low ratio indicates confidence For example, in 15, the PutCall.

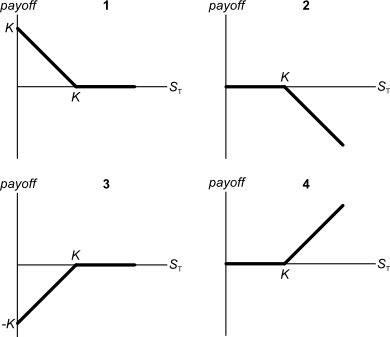

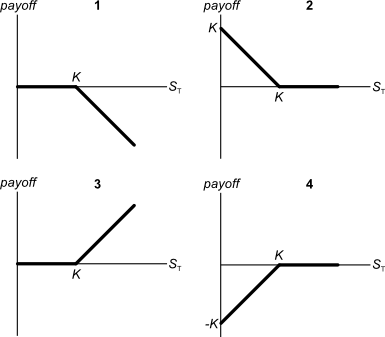

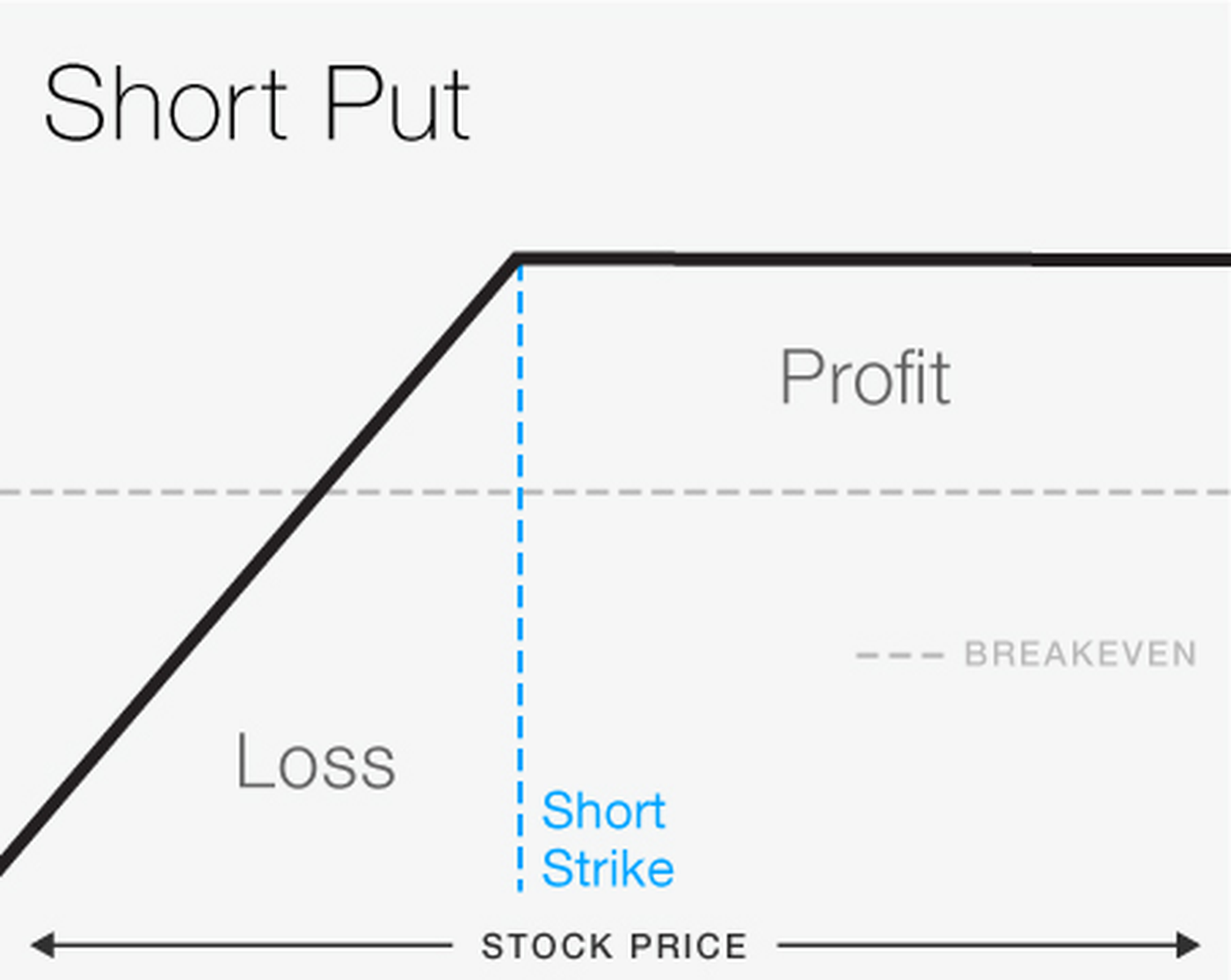

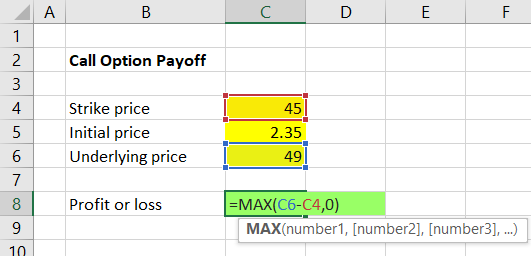

A call option allows buying option, whereas Put option allows selling option The call generates money when the value of the underlying asset goes up while Put makes money when the value of securities is falling The potential gain in case of a call option is unlimited, but such gain is limited in the put option In the call option, the. 4 Basic Option Positions Recap Of the four basic option positions, long call and short put are bullish trades, while long put and short call are bearish trades It may sound confusing in the first moment, but when you think about it for a while and think about how the underlying stock’s price is related to your profit or loss, it becomes very logical and straightforward. Exercise style of an option refers to the price at which and/or time as to when the option is exercisable by the holder.

Exercise style of an option refers to the price at which and/or time as to when the option is exercisable by the holder. Please support us athttps//wwwpatreoncom/garguniversity http//wwwgarguniversitycom Check out Ebook "Mind Math" from Dr Garghttps//wwwamazoncom/MIN. CALL and PUT Options Trading is very popular In layman terms, for the call and put option buyers or holders, the loss is capped to the extent of the premium.

Put and call options explained When purchasing call option and put option contracts, you are given the right but not the obligation to purchase the option contract at a set price This is known as the strike price One options contract is the equivalent of 100 shares of the stock For example, if you are looking at a stock and the technical. Call and put options are derivative investments, meaning their price movements are based on the price movements of another financial product The financial product a derivative is based on is often called the "underlying" Here we'll cover what these options mean and how traders and buyers use the terms What Are Call and Put Options?.

How To Sell Calls And Puts Fidelity

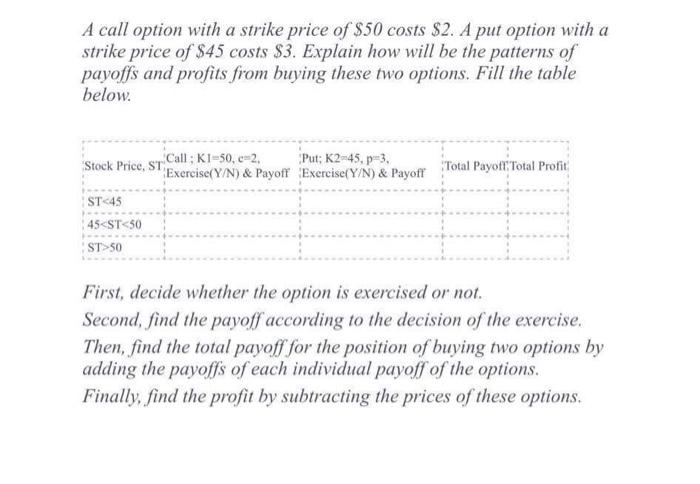

A Call Option With A Strike Price Of 50 Costs 2 Chegg Com

European Put And Call Option Prices P S Y K T And C S Y K T Download Scientific Diagram

Atm At The Money Call Put Options Moneyness Of Options Options Futures Derivatives Commodity Trading

Topic11 12 Options Denitions Call Option A Security That Gives Its Owner The Right But Not The Obligation To Purchase A Specied Asset For A Specied Course Hero

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Understanding How Options Are Priced

Http Www Fightfinance Com

What Is Straddle Definition Of Straddle Straddle Meaning The Economic Times

Call Put Options Put Option Option Finance

Long Call Option Long Call Strategy Firstrade Securities

Options Cfd Trading Trade Options Plus500

Options Calls And Puts Overview Examples Trading Long Short

Call Option Explained Online Option Trading Guide

Optionen Grundlagen Und Begriffe Optionsgrundlagen Online Broker Lynx

Intraday Strategy Call Put Trader Workstation Option Strategy Builder Proyectos Y Desarrollo Fjo

Put Option Wikipedia

:max_bytes(150000):strip_icc()/call-and-put-options-definitions-and-examples-1031124-FINAL-5bfd786646e0fb0026474cd7.png)

Call And Put Options What Are They

Options Trading Guide What Are Put Call Options Ticker Tape

Optionen Grundlagen Und Begriffe Optionsgrundlagen Online Broker Lynx

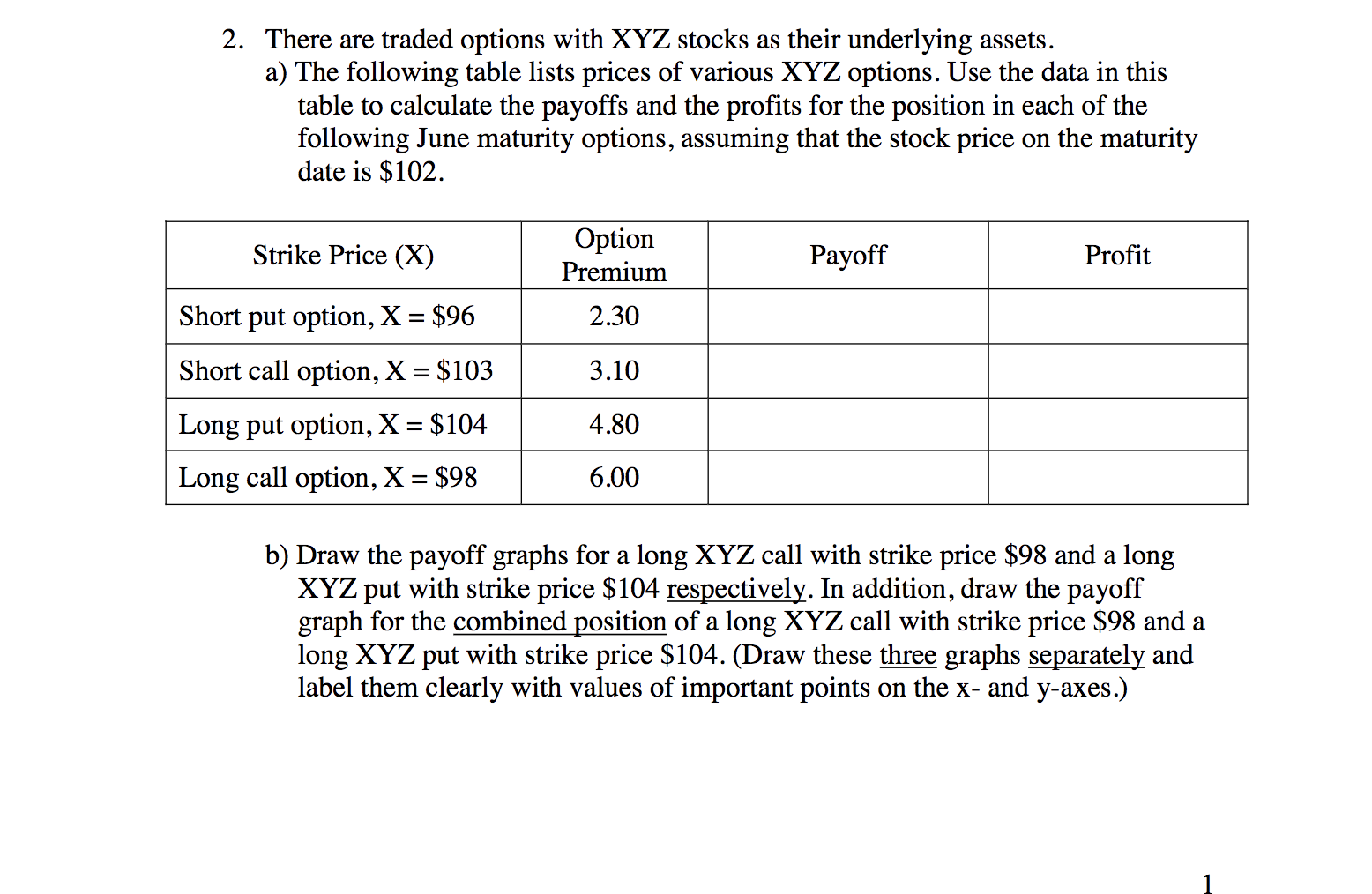

Solved A Bank Has Written A Call Option On One Stock And Chegg Com

Options Trading Guide What Are Put Call Options Ticker Tape

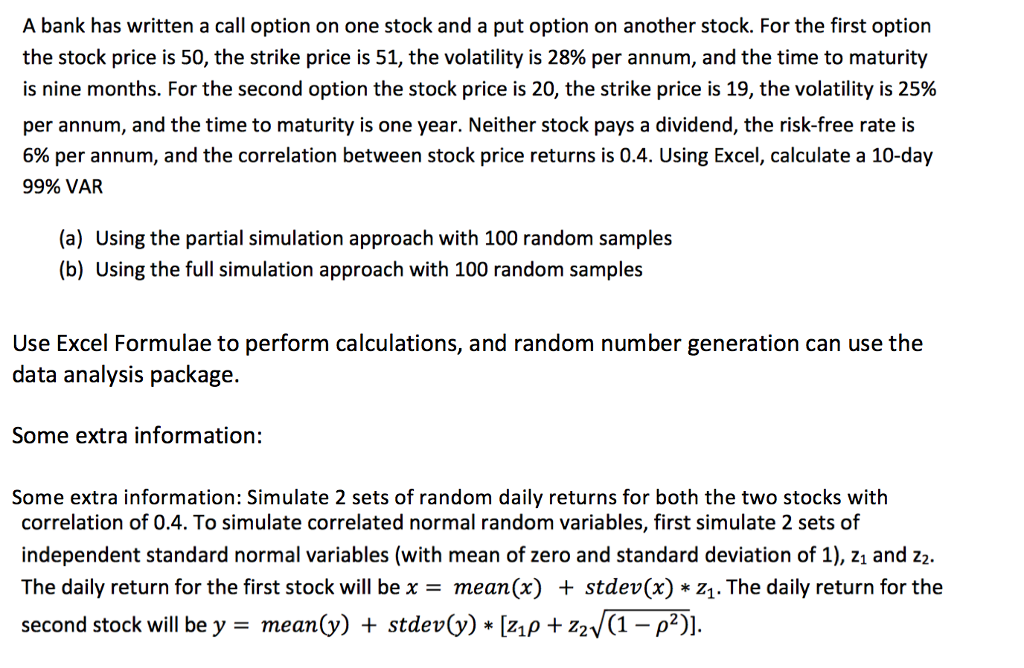

Call Options Vs Put Options Top 5 Differences You Must Know

Options Calls And Puts Overview Examples Trading Long Short

Basics Of Options Trading Explained

Warrants Vs Options Understanding The Key Differences Stock Investor

Short Call Vs Long Call Explained The Options Bro

Double Call Put Binary Options Iq Option Basic Iq Option Strategies In Options Trading Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

Put Option Definition

Perdisco Put Call Options Bus2 Studocu

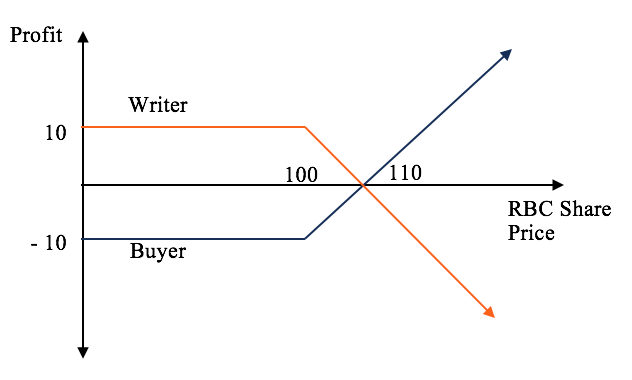

Solved 2 There Are Traded Options With Xyz Stocks As The Chegg Com

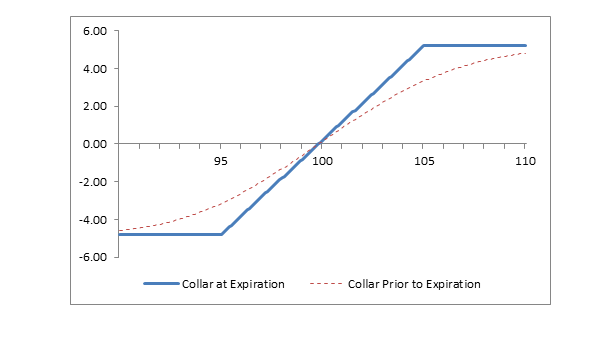

Collar Option Strategy Collar Trade Strategy Firstrade

Opciones Binarias High Call Y Low Put Leccion 7

Vinegarhill Financelabs Graphics

What Is A Collar Position Fidelity

3

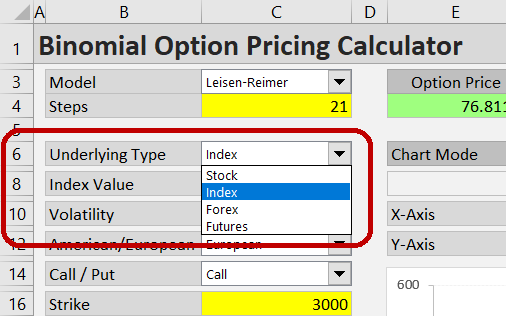

Index Options Binomial Option Pricing Calculator Macroption

1

Call Put Option Trade Home Facebook

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

Beginner S Guide To Call Buying

Puts Vs Calls In Options Trading What S The Difference Benzinga

Adding Multiple Call Put Options Payoff Functions Options Futures Derivatives Commodity Trading

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

Short Call Definition

Put Option And Call Option Contracts By Put And Call Brokers And Dealers Association Inc Very Good Soft Cover 2nd Edition Alanpuri Trading

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

10 Options Strategies To Know

What Is Put Call Ratio Definition Of Put Call Ratio Put Call Ratio Meaning The Economic Times

Call Option Wikipedia

Http Www Fightfinance Com

What Is Option Trading 8 Things To Know Before You Trade Ally

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Protective Put Definition

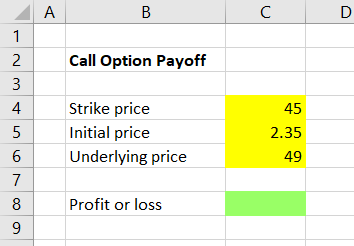

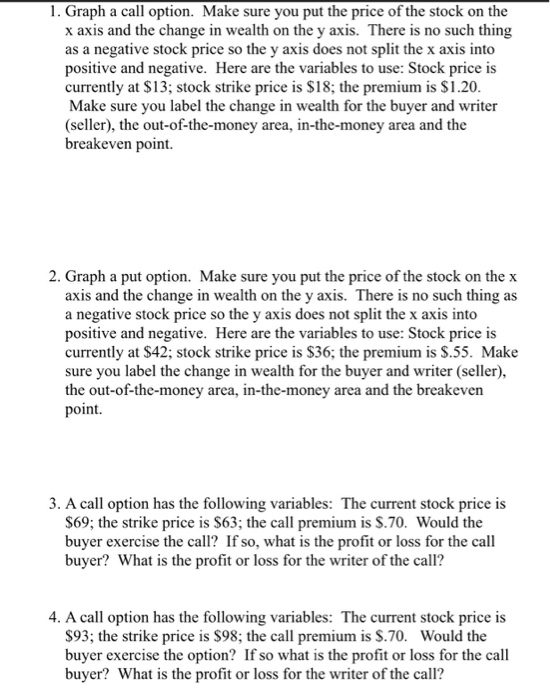

Calculating Call And Put Option Payoff In Excel Macroption

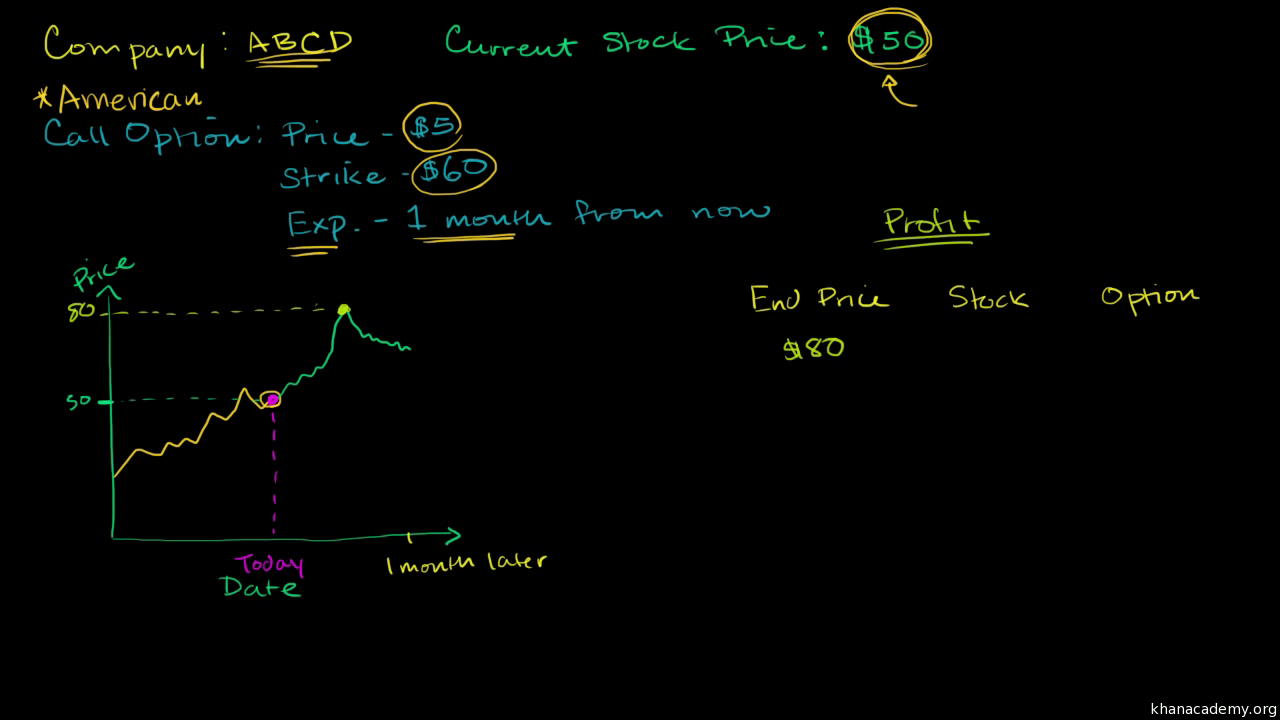

Call Options Intro American Finance Investing Video Khan Academy

Call Options Intro American Finance Investing Video Khan Academy

Call Vs Put Option Basic Options Trading Principles

Currency Options An Option Is A Contract In Which The Buyer Of The Option Has The Right To Buy Or Sell A Specified Quantity Of An Asset At A Pre Specified Ppt

:max_bytes(150000):strip_icc()/PutCallRatio-5c813e7946e0fb00019b8efa.png)

Put Call Ratio Definition

Find Historical Option Price For Given Ticker Date And Strike Price Closest Trading Price Forum Refinitiv Developer Community

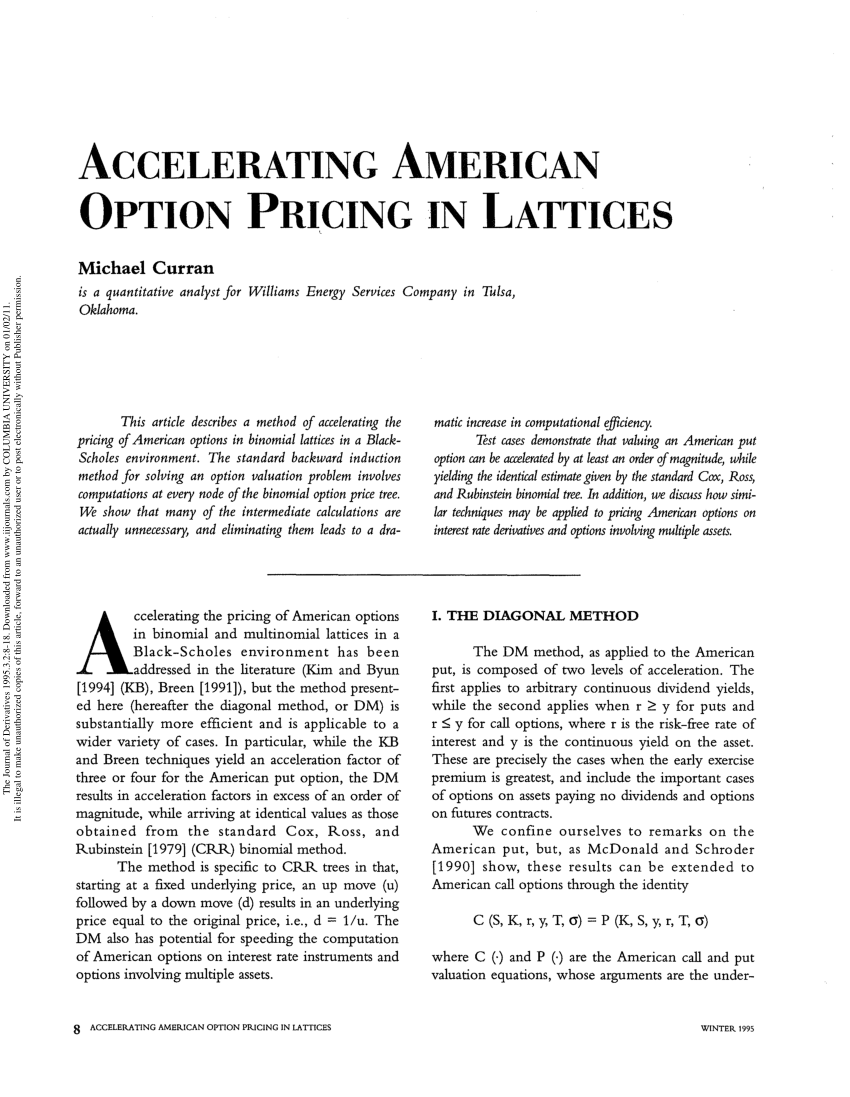

Pdf Accelerating American Option Pricing In Lattices

Call Put Options Put Option Option Finance

In The Money Learn About In The Money Options Tastytrade Blog

Options Calls And Puts Overview Examples Trading Long Short

Call Put Options Call Option Put Option Stock Option Financial Option Option Strategies Call Strategy Put Strategy Callputoptions Ygraph Com

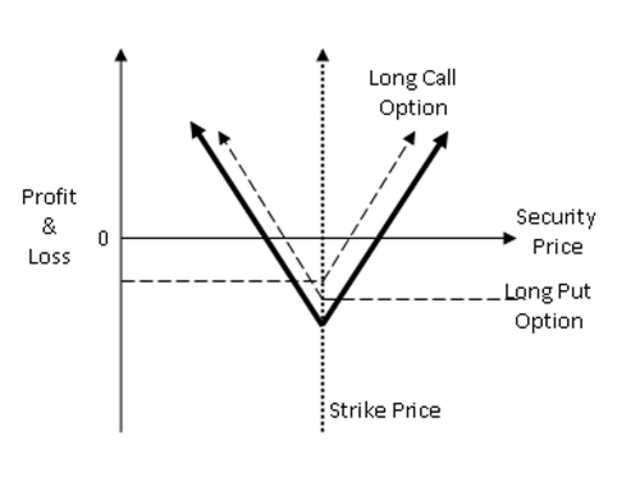

Exercises Derivatives Pricing And Hedging Feb Eur Studocu

Options Trading Guide What Are Put Call Options Ticker Tape

Figure B2 D Left And G Right For The American Put Option Of Table Download Scientific Diagram

Image Of Concept Buy And Sell Word Design Image For Stock Market Put And Call Option Xb Picxy

Delta Hedging Simplify Your Option Pricing Refinitiv Developers

1 5pts Sketch The Graph Of The European Call Op Chegg Com

Call Option Wikipedia

The Short Option A Primer On Selling Put And Call Op Ticker Tape

Solved For At The Money European Call And Put Options On Chegg Com

Options Futures And Other Derivatives Book Solutions Studocu

Be In The Money Understanding Trading Strategies By Farhad Malik Fintechexplained Medium

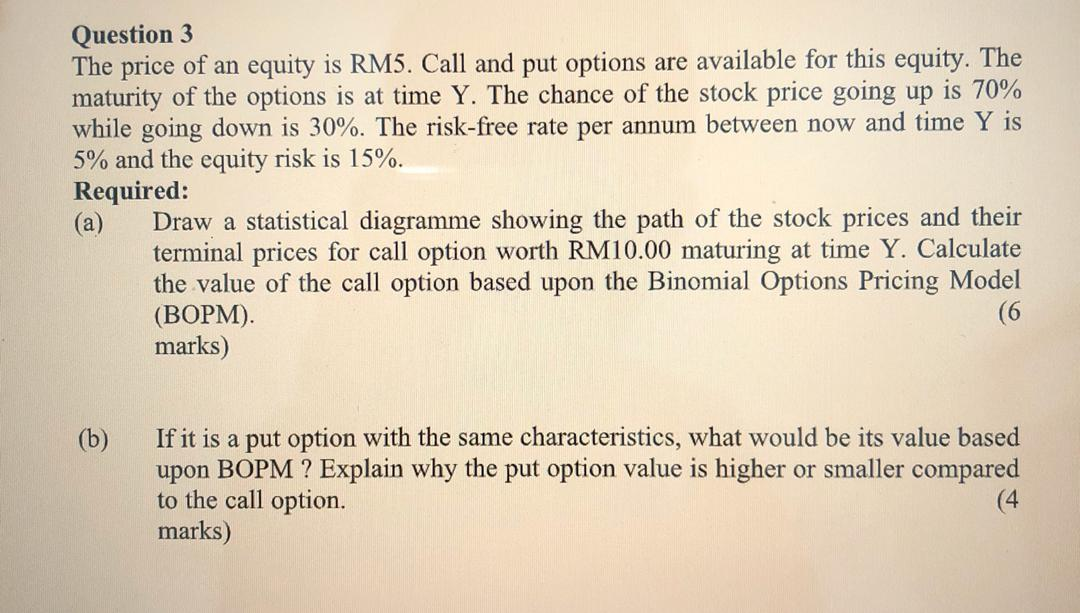

Solved Question 3 The Price Of An Equity Is Rm5 Call And Chegg Com

Image Of Concept Buy And Sell Word Design Image For Stock Market Put And Call Option Ln Picxy

Short Call Vs Long Call Explained The Options Bro

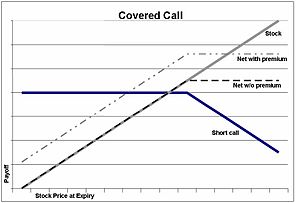

Covered Call Wikipedia

Adding Multiple Call Put Options Payoff Functions Options Futures Derivatives Commodity Trading

European Put And Call Option Prices P S Y K T And C S Y K T Download Scientific Diagram

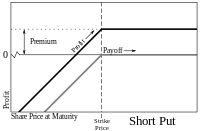

Put Option Wikipedia

Solved 1 Graph A Call Option Make Sure You Put The Pric Chegg Com

Option Pricing Model International Finance Lecture Slides Docsity

Call And Put Synthetic Long Stock Option Trading Guide

Covered Call Wikipedia

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Call Option Definition

Call Option Vs Put Option Difference And Comparison Diffen

Calculating Call And Put Option Payoff In Excel Macroption

Call Option And Put Option Svtuition

3

Call Option What Are Call Put Options The Economic Times

Short Call Vs Long Call Explained The Options Bro

.png)

Descubre Las Diferencias Entre Las Opciones De Compra Call Y Venta Put

The Put Option Call Option Method Of Binary Options Trading The Put Option Call Option Method

Call And Put Synthetic Long Stock Option Trading Guide

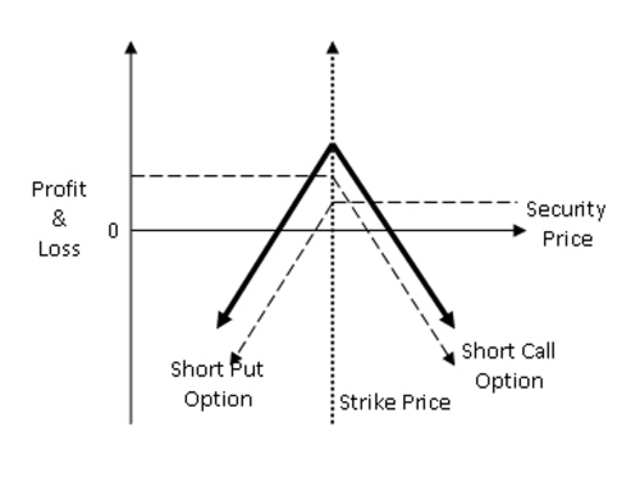

What Is Straddle Definition Of Straddle Straddle Meaning The Economic Times

Chapter Understanding Options Pdf Free Download

Solved Answer The Following Questions On Option Pricing Chegg Com

Puts Vs Calls In Options Trading What S The Difference Benzinga